The loss or theft of documents is still a very common situation and deserves attention in Brazil. Serasa Experian, the first and largest datatech in Brazil, conducted a survey among consumers to understand the impact of this situation and presented in the “ Digital Identity and Fraud Report 2024” the results: 14% of participants said they lost their documents in the last year, and 4% of the total had their data used in some type of fraud.

The study also recorded another worrying fact: 21% of respondents stated that they have already lent their personal data to third parties, whether to make an online purchase (74%), open a bank account (21%) or get a loan (15%). The director of Authentication and Fraud Prevention, Caio Rocha, warns that lending data to third parties is a worrying practice and highlights the need for greater awareness of the risks associated with this practice, such as being associated with crimes such as fraud and falsehood.

“On the one hand, institutions must implement robust security and authentication measures, but on the other, it is essential that users understand the risks of this conduct and best practices for protecting their online and offline identities. Data security is not only an individual responsibility, but a collective issue that requires constant action and attention from both companies and individuals”.

Evaluating the total number of respondents who had lost or stolen documents (13.8% of respondents), we note that the index rises 10 percentage points (24%) among those who have 18 to 29 years old 10% among men and have their documents stolen. Men also have a higher rate of loss or theft of documents than women when evaluated by gender, reaching 17% among men and falling to 10% among women.

4 In 10 have been victims of fraud and more than half have suffered financial loss

Also according to the survey, four out of ten people have suffered fraud in Brazil (42%), of which 67,9% had financial losses between R$ 100 and R$1,000, 23,7% between R$ 1,000 and R$ 10 thousand and 6,3% more than R$ 10 thousand. The average was R$ 2,288 per person, that is, almost a month and a half of work for those who earns a salary.

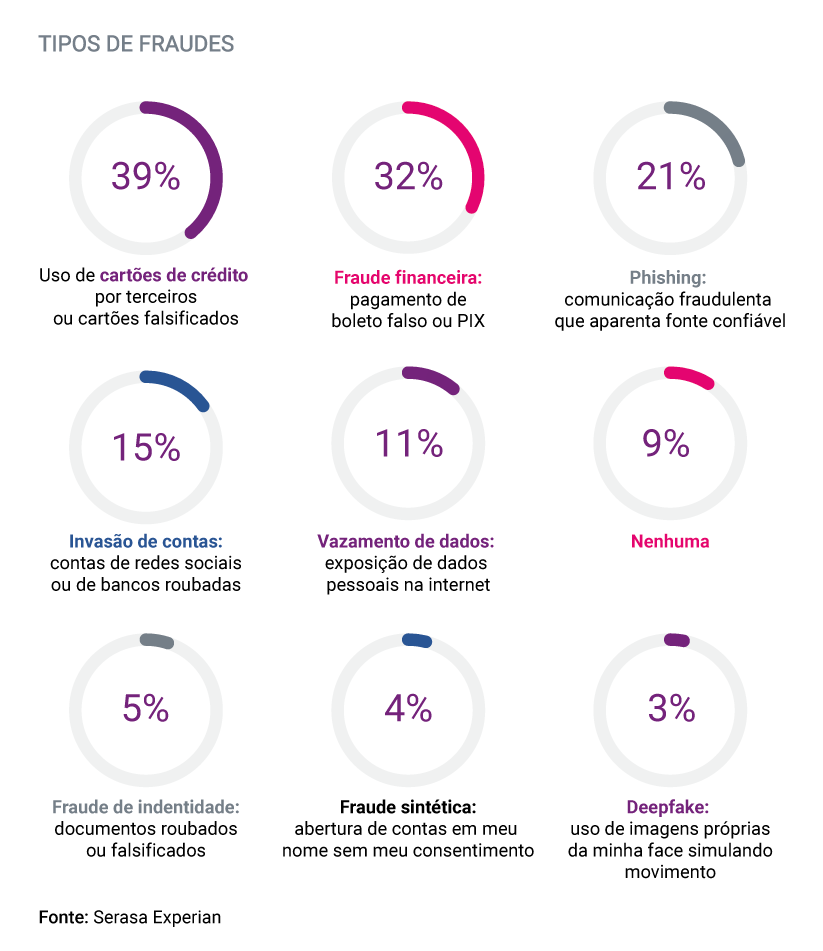

The most recurrent type of scam reported by respondents was the “use of credit cards by third parties or counterfeit” card (39%). See, in the following chart, the details of fraud modalities that respondents were victims of the most:

Expert gives safety tips

For Caio Rocha, security measures are crucial to protect consumers against fraud.“Data security requires continuous action and constant surveillance by consumers.Awareness of risks and the implementation of safe practices are key to mitigate these problems and protect documents and personal information, avoiding financial losses “, says Caio.

1. Organization and categorization: Keeping documents organized and categorized by type, date, and relevance facilitates access control and minimizes the risk of loss. This also streamlines the location of specific documents, increasing operational efficiency.

2. Security copies: Making backup copies (backups) of important documents is essential to prevent loss of information in cases of system failures, natural disasters or cyber attacks. These copies should be stored in different and secure locations such as protected clouds or physical vaults. It is recommended to implement a regular backup plan, including automatic and manual backups, and periodically test the integrity of these backups to ensure data recovery when necessary.

3. Prefer digital documents: Use digital documents to minimize risks of forgetfulness or theft. Store them in secure clouds with controlled access, set up automatic alerts and reminders, and create regular backups. Scanning facilitates remote access and ensures greater security and practicality. However, do not deliver them to unknown people or companies to prevent them from being cloned. Do not store copies or photos of the documents on your mobile phone, since it can be stolen or cloned and the information can be used in fraud.

4. Credit Cards: Do not share your card information and always check the authenticity of the websites before making online purchases.

5. Fake or PIX Boletos: Always check the beneficiary's data before making payments. Use official banking applications to prevent fraud.

6. Phishing: Do not click on suspicious links received by email or messages. Check the source of communications before providing any information.

7. Invasion of Accounts: Use strong passwords and enable two-step authentication to protect your social and banking accounts.

8. Use of security technologies: Advancement in technologies has brought powerful tools for document protection. Encryption protects data by encoding it, and multi-factor authentication (MFA) ensures access only to verified users.

Methodology

Participated in the interview 804 individuals. With margin of error of 3.5% and confidence interval of 95%, the research was applied via online panel in November 2023 and sought to understand the profile of people victims of fraud and their feeling in relation to the scams.

The profile of the respondents revealed that 51% were men and 49% women, from social classes B (50%), C (32%) and A (18%). The place of residence of 41% of the participants is in Capital, 33% in the interior of the state and 26% in metropolitan regions. Regarding the regions, 45% of the interviewees are from the Southeast region, 26% from the Northeast, %3T and 1T1T13T1.

The mean age of the respondents was 39 years, and the breakdown reveals 26% with 50 years or more, 22% with 30 to 39 years, 20% with 18 to 24, 19% with 40 to 49 and 13% with 25 to 29 years.