One of the biggest enigmas in Brazilian e-commerce is its high cart abandonment rate, which already exceeds 80%To better understand the reasons, OneKey Payments released the study "Disruptive Payments," which reveals the key points hindering a purchase journey.

– 62,6% Two consumers have already abandoned an online purchase due to the excessive amount of required data in the form.

– 92,8% They abandoned the transaction because they were unable to access the device where the authentication code (OTP) was sent.

– 93,7% They interrupted the purchase because the site didn't load properly.

Complicated payment processes, slow pages, and unexpected requirements are among the main reasons. However, the payment institution responsible for the survey believes that new technologies and payment models have the potential to solve this historical problem of digital commerce in Brazil. "What the data clearly shows is that payment friction has been a key, but little-explored, factor in abandoned purchases," explains César Garcia, CEO of OneKey Payments. "On the other hand, many of the problems pointed out by consumers can already be resolved with innovative solutions."

While retailers are starting to recognize the importance of the payment stage in sales conversion, the survey indicates that only just over half (54%) Retailers consider the payment experience to be crucial for brand reputation.

César compares this number to the number of consumers: nearly three out of every four (73,1%They argue that the preferred payment method and process can be decisive when choosing between two competing brands.

"There is still a disconnect between how much the consumer values the payment experience and how much the merchant sees that value," he assesses. Almost nine out of ten consumers (87,5%) consider their preferred payment process and method as 'important'73,1%) or 'fundamental' (14,4%in the purchase decision.

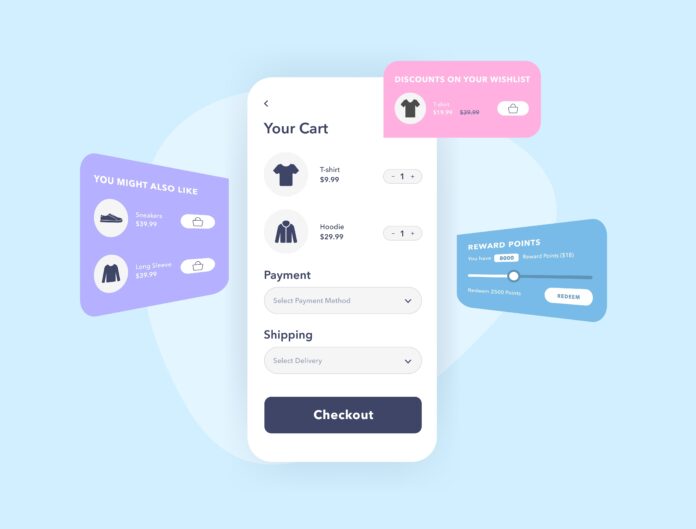

Today, the digital consumer expects quick, one-click payments and readily abandons lengthy or complicated checkout journeys. "Payment isn't just technology, it's trust, loyalty, and sustainable growth," he states. "If you offer the Brazilian consumer an intuitive, secure, predictable, and frictionless process, your brand will be as valuable as the product or service itself."

The company points to Pix as an example of how technology, when designed with the user in mind, can overcome shopping cart abandonment barriers. Pix has already surpassed credit cards as a payment method. most used for online purchases, and it's already more popular than cash In person payments. "It's simple, secure, and fast; essentially everything a payment should be. And with recurring payments, especially with the recent launch of..." Automatic PixThe system redefines how brands can offer convenience and loyalty by eliminating repetitive steps in recurring purchases, such as subscriptions and recurring services. The payments market and online retail still have much to learn from Pix," comments the executive.

Technologies like one-click payments, recurring payments, biometric authentication, and advanced fraud detection systems are already available to payment institutions and retailers, and can definitively resolve the longstanding obstacles of e-commerce. Digital wallets, acting as a “virtual wallet” within a mobile phone, securely store card details and prevent consumers from having to re-enter them with each purchase. This makes the process faster and reduces the likelihood of abandonment. Furthermore, innovations in fraud prevention, using artificial intelligence and machine learning, enhance security without adding barriers like codes sent to secondary devices.

With abandonment rates still so high, payment providers now need to integrate these solutions with a focus on security and operational efficiency, demonstrate their benefits to retailers, and, most importantly, deliver the buying experience that consumers not only expect, but demand," concludes César.