Dialogo, the carrier of the BBM Group, specialized in deliveries for e-commerce and marketplaces, announces the expansion of its services beyond the last mile, also operating with the Midpack, Inject and Inhub modalities.

Each modality operates at a specific stage of the logistics chain and has been implemented to ensure greater control, reduction of unnecessary steps and agility in the transportation and processing of goods.

According to Dialogo, customers will benefit from reduced operating and transportation costs thanks to route optimization and cargo consolidation.

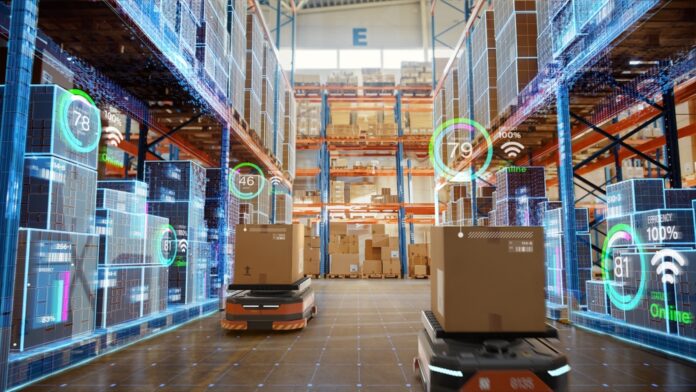

Another advantage is the possible integration of these modalities with technologies such as control tower, applications and tracking systems to ensure real-time tracking and transparency of product movement in all logistics steps, thus increasing the reliability of operations.

“With centralized information and real-time tracking, digital retailers can also improve inventory control and have greater accuracy in the management of” orders, says Jorcei Chiochetta, director of fractional shipping and e-commerce.

The new modalities will also allow digital retail to optimize the predictability of deliveries, increasing consumer satisfaction and reducing cart abandonment for long periods, as well as making the operation more flexible in multiple sales channels, with the possibility of pick-up in hubs or home delivery.

What are the new modalities and their differentials

The Midpack mode is focused on products between 2kg and 10kg and includes all stages of transport, ie, the management of orders between distribution centers and urban hubs. Its differential is to optimize the intermediate flow before final delivery, ensuring efficiency and control on the route between large centers.

Inject allows the consolidation and injection of volumes directly in the distribution centers of Dialogo, speeding up the processing and reducing steps in the logistics cycle. In this way, the customer takes the products directly to the destination terminal and the company makes the final delivery to the consumer.

Finally, the Inhub mode is a cross-docking and transshipment operation in urban hubs, allowing the rapid transfer of goods between modes and reducing the delivery time of orders. In practice, the customer leaves the cargo in a BBM terminal closer and Dialogo follows with the transfer and delivery flows to the consumer.

“We want to strengthen our position as a strategic partner of e-commerce, offering solutions that boost logistics efficiency with faster, more predictable and more controlled deliveries.All this to promote a great experience to the end consumer and the sustainable growth of the digital business of our customers”, says Chiochetta.

The Dialogue already works with other operations such as: Standard (collection, transfer and delivery for packages from 1kg to 2kg); Same Day (same day delivery); Ship From Store (collection in customer stores and direct delivery to the final consumer); Express (deliveries up to 48h in capital); Omnichannel (collection in the customer's central Distribution Center and consumer delivery); Marketplace (collection in sellers and delivery to the final customer); and Middle Mile (transfer of goods between customer CDs).