The South region recorded 559,236 fraud attempts in the first quarter of 2025, representing 16.1% of the national total and an average growth of 21% compared to the same period the previous year. The data comes from Serasa Experian’s Fraud Attempt Indicator, Brazil’s first and largest datatech. The region ranked third in the national occurrence ranking, behind only the Southeast, which accounted for 47.1% of the national total, and the Northeast (20.3%).

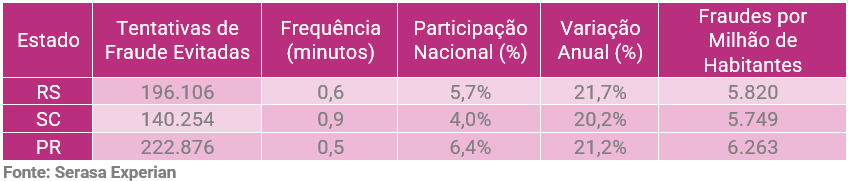

Breaking down by Federative Units (UFs), Paraná led both in volume and population density, with 222,876 records and a rate of 6,263 attempts per million inhabitants, equivalent to one attempt every 35 seconds. Rio Grande do Sul showed the highest annual variation in the region, with a 21.7% increase. Meanwhile, Santa Catarina, despite recording the region’s lowest numbers in absolute volume, density, national share, and frequency, still stood out for the increase in occurrences, with a 20.2% rise compared to the first quarter of 2024. See the consolidated regional data from January to March 2025 in the table below:

National overview: Fraud attempts grow 22.9% in Q1

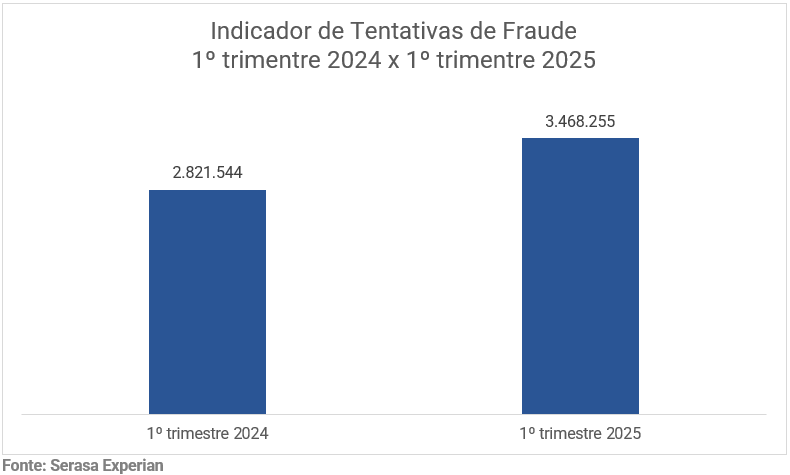

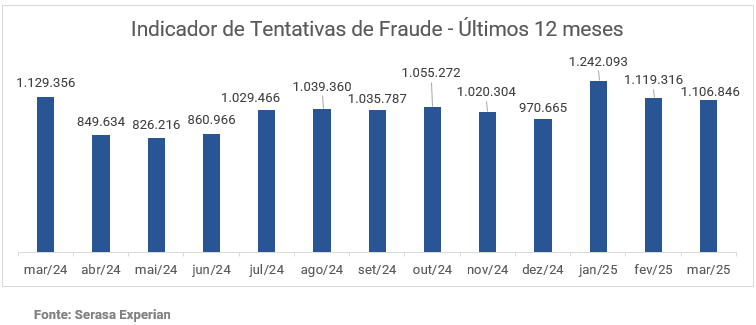

Brazil recorded 3,468,255 fraud attempts in the first three months of 2025—a 22.9% jump compared to the same period last year, according to Serasa Experian’s Fraud Attempt Indicator, the country’s first and largest datatech. The volume equates to one attempt every 2.2 seconds, with over 1 million monthly occurrences recorded consecutively in the quarter.

See the annual comparison in the chart below:

“We have observed a concerning acceleration in the sophistication of fraud attempts. Since there is no single solution capable of stopping these attempts, companies need to adopt a layered antifraud methodology, technologies that can work in an integrated and preventive manner throughout the user journey. These are essential to block attempts at their source before they cause harm through social engineering strategies, now amplified by the use of artificial intelligence to create hyper-personalized approaches,” says Caio Rocha, Director of Authentication and Fraud Prevention at Serasa Experian. “In addition to technology, it is crucial to continuously invest in consumer education so they can recognize and avoid new scam formats,” he adds.

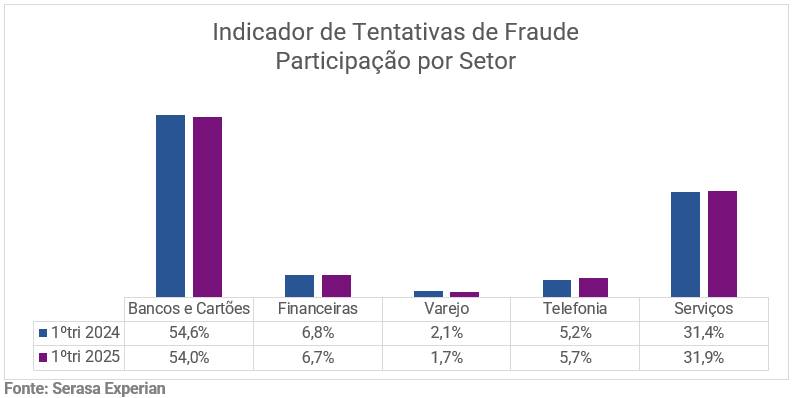

Banks and Cards account for over half of attempts

Most fraud attempts recorded in the first quarter of 2025 targeted the ‘Banks and Cards’ sector (54%). Next were the ‘Services’ (31.9%), ‘Financial Institutions’ (6.7%), ‘Telecommunications’ (5.7%), and ‘Retail’ (1.7%) segments, maintaining consistency across all three months. See the sector breakdown and comparison with the same period in 2024 in the chart below:

In the analysis by modality, inconsistencies in registration information are the main detection front for fraud attempts, representing 50.6% of prevented occurrences in the first quarter. Next, fraudulent patterns related to document authenticity and biometric validation accounted for 41.9% of cases. Meanwhile, monitoring suspicious behaviors on devices—such as association with previous fraud histories—was responsible for 7.5% of blocked attempts in the period.

Fraud attempts increasingly target the population over 50

Breaking down by age group, consumers aged 36 to 50 remained the most targeted, accounting for 32.9% of fraud attempts recorded in March. Next were the groups aged 26 to 35 (26.5%) and up to 25 (15.3%). Consumers aged 51 to 60 accounted for 13.4% of occurrences, while those over 60 represented 11.9% of the total.

Compared to March 2024—the month that recorded the highest volume of fraud last year—only two of the mapped age groups showed an increase in occurrences in the same month of 2025: a 3.7% rise among consumers aged 51 to 60 and a 7.9% increase among those over 60. All others recorded a decline in annual variation, reinforcing the trend of fraud concentration among older population segments.

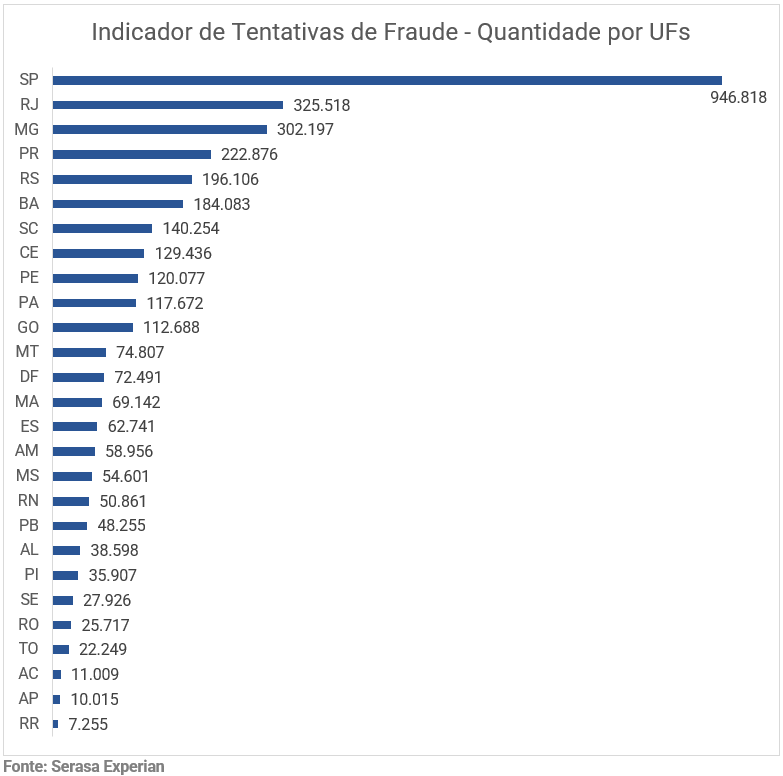

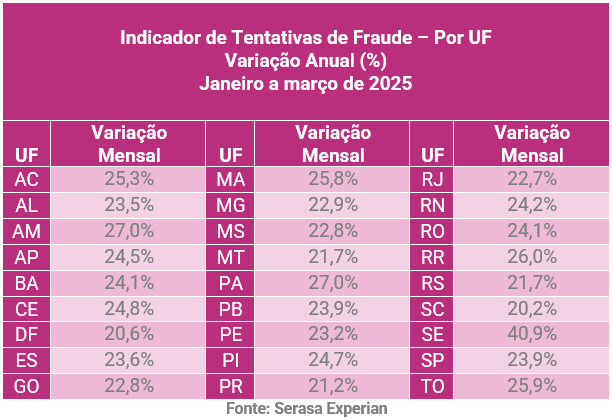

Fraud surges in all states; SP approaches 1 million attempts

All Federative Units (UFs) in Brazil recorded significant increases in fraud attempts in the first quarter of 2025, with accumulated variations exceeding 20% compared to the same period the previous year. The highest increases occurred in Pará and Amazonas, both recording 27.0%, followed by Roraima (26.0%). Even the states with the smallest growth in comparison—Santa Catarina (20.2%), Distrito Federal (20.6%), and Paraná (21.2%)—showed concerning rates.

In absolute volume, the Southeast remained the region most targeted by fraudsters, with 1,637,274 fraud attempts recorded in the quarter—equivalent to 47.2% of all attempts in the country. The region had an average variation of 22.6% compared to the first three months of 2024.

Among the states, São Paulo led by a wide margin, with nearly 1 million fraud attempts blocked in the period. Next were Rio de Janeiro (325,518) and Minas Gerais (302,197). At the other end of the ranking, the smallest volumes were recorded in Acre (11,009), Amapá (10,015), and Roraima (7,255). See below a chart with the number of fraud attempts per UF and a table with the accumulated annual variations for this period:

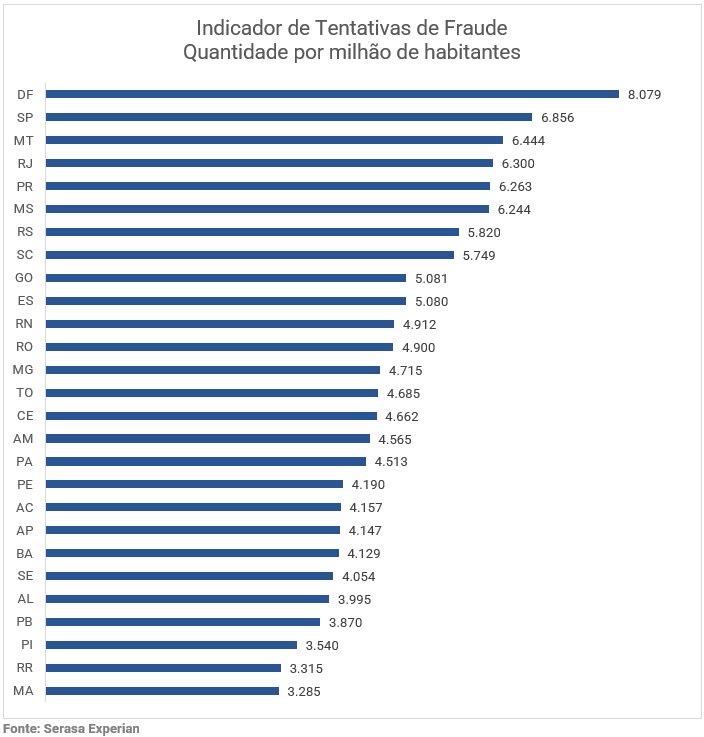

When considering the fraud attempt rate proportional to the population, Distrito Federal tops the national ranking, with 8,079 occurrences per million inhabitants in the first quarter of 2025. The rate is more than double that recorded in Maranhão, which ranks last with 3,285 occurrences per million inhabitants. Right after DF, São Paulo (6,856), Mato Grosso (6,444), and Rio de Janeiro (6,300) stand out, reinforcing the higher fraudulent pressure in regions with strong economic activity. See the chart below with the complete data per million inhabitants:

Monthly overview: March saw a slight drop in monthly variation, but volume remains above 1 million

Brazil recorded 1,106,846 fraud attempts in March 2025 alone—equivalent to an average of 25 occurrences per minute or one every 2.4 seconds. Despite the significant number, the month showed a slight 1.1% contraction compared to February. Nevertheless, the level remains high, with every day in March recording over 35,000 attempts blocked by Serasa Experian’s antifraud technologies.

See the monthly data for the last 12 months in the chart below:

“Combating fraud requires constant action, advanced technology, and a strategic vision that combines innovation with education. At Serasa Experian, we remain committed to offering increasingly comprehensive solutions to anticipate risks, protect digital identities, and support businesses and consumers in building safer journeys,” concludes Rocha.