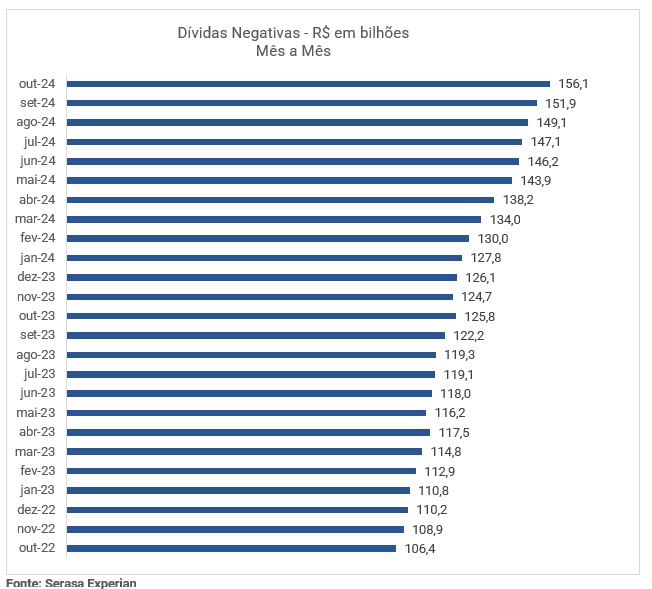

October recorded 7.0 million defaulting companies, the highest number in the historical series of the Serasa Experian Business Default Indicator, the first and largest datatech company in Brazil. This total represents 32.3% of companies existing in Brazil. The total debt amount reached a record high of R$ 156.1 billion. On average, each CNPJ had about 7.4 delinquent accounts during the period. Below are the data for the last 24 months (quantities and debt amounts):

“This increase in defaults can be largely attributed to rising interest rates. When interest rates rise, the cost of credit for companies also increases, making it more expensive and difficult for them to obtain financing. This directly affects companies’ ability to manage their cash flow and meet their financial obligations. Additionally, higher interest rates may reduce demand for products and services, as consumers and other businesses also face higher credit costs, resulting in lower revenue for companies. This scenario creates a vicious cycle, where difficulty accessing credit and reduced revenue lead to an increase in defaults, negatively impacting companies’ financial health,” comments Serasa Experian economist Luiz Rabi.

“Services” sector led the default rate in October

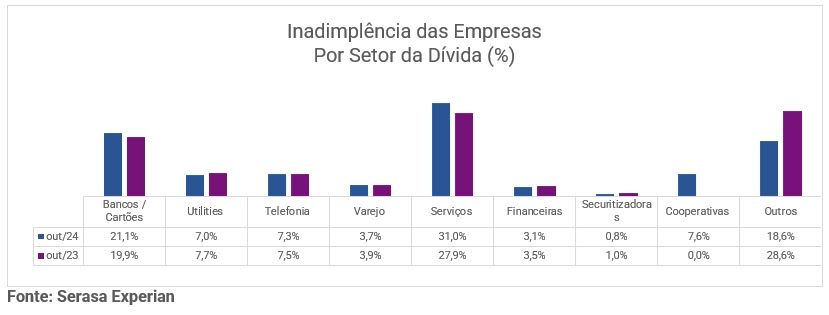

The “Services” sector accounted for the majority of companies with delinquent obligations (56.2%). This was followed by “Commerce” (35.4%), “Industry” (7.3%), “Primary” (0.8%), and the “Other” category (0.3%), which includes the Financial and Third Sector segments. Regarding the sector of the debts, the “Services” category represented the largest portion (31.0%), followed by “Banks and Cards” (21.1%). See the detailed breakdown below:

Maranhão led the ranking of companies with overdue accounts

In October, the analysis of the Federative Units revealed that Maranhão had the highest business default rate in the country, with 43.0% of the state’s companies having their CNPJ in the red. Following closely were Alagoas (42.3%) and Amapá (40.8%), which also stood out among states with the most companies facing financial delinquencies. See the full details in the chart below:

Of the 7.0 million defaulting companies in October, 6.5 million were micro and small businesses. Together, these companies accumulated 46.5 million debts, totaling R$ 134.1 billion. On average, each defaulting company had 7.1 overdue accounts. See the breakdown by federative units below:

To check more information and the historical series of the indicator, click here.

Methodology

The Serasa Experian Business Default Indicator includes the number of Brazilian companies in default status, meaning they have at least one overdue and unpaid obligation, recorded on the last day of the reference month. The Indicator is segmented by federative unit, size, and sector.