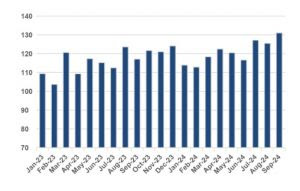

The Omie Economic Performance Index of SMEs (IODE-SMEs) indicates an 11.9% increase in the financial turnover of small and medium-sized Brazilian companies (SMEs) in September 2024, compared to the same period last year. Year-to-date, the index records a 5.8% increase compared to the same period in 2023.

Figure 1: IODE-SMEs (Index number – base: average 2021 = 100)

Source: IODE-SMEs (Omie)

The IODE-SMEs serves as an economic indicator for companies with annual revenues of up to R$50 million, divided into 701 economic activities that make up four major sectors: Commerce, Industry, Infrastructure, and Services.

Felipe Beraldi, economist and manager of Indicators and Economic Studies at Omie, a cloud-based management platform (ERP), indicates that the growth of SMEs in September was widespread among sectors. “The maintenance of positive signs in the Brazilian macroeconomic environment from the perspective of the labor market and family income continues to drive the performance of SMEs, while consumer confidence, measured by the FGV indicator (ICC-FGV), is showing an uptrend in the recent period, reinforcing the positive context for consumption,” he contextualizes.

The highlight was for Commerce, which recorded a 19.2% growth in September compared to the previous year – one of the best results in the segment in 2024 so far. “The consistent recovery in recent months, both in wholesale and retail, suggests a promising end of the year for SMEs in the sector. This context raises expectations for the impact of seasonal dates, such as Black Friday, on the companies’ revenue in the coming months,” explains the economist.

Industrial SMEs returned to positive territory in September, after a slight decline in the previous month, registering a progress of 11.8% on an annual comparison. Among the 22 monitored subsegments of the manufacturing industry, 18 showed an increase in revenue, with the activities of ‘Furniture Manufacturing’, ‘Manufacture of metal products’, and ‘Manufacture of pulp and paper products’ standing out.

In the Services sector, SMEs advanced by 7.3% in September, with a noteworthy mention of the high comparison base of 2023 due to the recovery the sector was already experiencing at that time. Throughout the month, the performance was driven by improvement in ‘Administrative activities’ and ‘Delivery activities’.

Finally, SMEs in the Infrastructure sector recorded an increase of 11.3% in real financial movement in September. The segments of ‘Electricity’ and ‘Specialized services for construction’ prevailed in driving the sector’s growth throughout the third quarter.

The positive result in the last month contributes to the positive maintenance of Brazilian SMEs’ revenues in the short term. ‘Even with prospects for increasing inflationary pressures and interest rates, factors such as high consumer confidence and persistently low unemployment levels should support the continued growth of SMEs in the coming months,’ predicts Beraldi.