Buy now, pay later Applied to business-to-business relationships, it emerges as an alternative to boost sales without compromising the seller's cash flow.

In this model, the corporate client purchases goods or services and splits the payment without using a card. Meanwhile, the supplier can receive payment upfront through a financial partner.

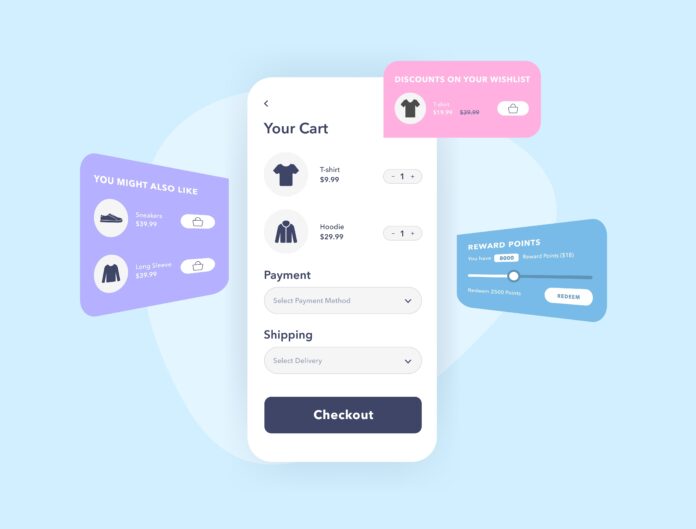

Comprehensive platforms, such as MOVA (Serasa Experian), provide end-to-end infrastructure: technology, credit analysis, billing, and compliance. Integration via API or White Label facilitates adoption and enhances the checkout experience.

The following guide explains when this solution makes sense, how it differs from cards or installment plans, and which risks will require attention from product, finance, and commercial teams.

In short: it is a tool to provide more flexibility to the buyer, improve predictability for the seller, and keep pace with the market's digital growth.

Key Takeaways

- Understand the dynamic: corporate buyer pays in installments, seller receives upfront payment.

- Evaluate the platform: integration, credit engine, and billing.

- Compare the experience with cards and installment plans.

- Pay attention to risk, data, and compliance.

- Focus on useful KPIs for product and financial decisions.

What is BNPL and why the model is gaining traction in Brazil

A digital installment solution allows companies to make a purchase and split the payment under clear terms, directly at checkout. This format facilitates higher-value purchases without relying on card limits.

Definition and business application

In practice, a supplier offers installment payments to the corporate client at the moment of payment. The operation is 100% digital and transparent: installments, fees, and terms appear in the finalization flow.

Why it advances with e-commerce and digital checkout

The growth of e-commerce and the consolidation of digital checkouts make this method attractive. International studies show 10%–15% adoption in specific categories, indicating local potential.

What lies behind the simple experience

Although the journey seems easy, there is a credit operation involving analysis, decision, and billing. Technology and data balance approval and risk, enabling higher conversion and less payment abandonment.

| Aspect | Integrated checkout | Generic installment plan | Commercial impact |

|---|---|---|---|

| Transparency | Installment and fee alert | Post-sale information | Less friction |

| Speed | Decision in seconds | Manual process | Higher conversion |

| Reach | Clients without cards | Depends on traditional credit | Unlocks purchases |

BNPL B2B (Buy Now Pay Later for Businesses) in practice: how the operation works

The operational process begins when the buyer confirms the payment method and fills out a short form. Then, the platform triggers an analysis automated with a credit engine, delivering a decision in near real-time.

The step-by-step at checkout

Corporate client selects the installment option, provides minimal data, and receives a quick response. The 100% online analysis defines the limit, number of installments, and any down payments.

Who pays whom

In the model with a financial partner, the seller receives payment upfront (e.g., D+1) and the client settles in installments. This relieves the seller's cash flow and transfers risk to the partner.

Models and infrastructure

There are two paths: the partner assumes the risk and pays upfront; or self-management, with the company financing the portfolio and handling billing internally. The trade-off involves margin, risk, and operational complexity.

| Item | Financial partner | Self-management |

|---|---|---|

| Risk | Assumed by partner | Company |

| Receipt | Upfront (D+1) | In installments according to portfolio |

| Complexity | Low | High |

| Infrastructure | API / White Label | Complete platform and billing schedule |

Critical components: reconciliation, contract formalization, anti-fraud, and continuous portfolio monitoring. These solutions enable the operational flow to function in both digital and physical environments.

BNPL B2B vs credit card, installment plans, and other forms of payment splitting

Offering point-of-sale installment plans at the time of purchase reduces reliance on the corporate card and changes the payment experience.

Differences in limit, bureaucracy, and experience

Installment plans linked to the purchase do not consume the customer's credit limit. do corporate card This preserves spending capacity for other expenses.

Already the Credit card functions as a revolving line: expenses accumulate on the invoice, and the revolving balance can generate high interest.

Traditional installment credit often requires more documentation and has slower approval, increasing sales friction.

Cost comparison: interest, fees, and penalties

Many checkout offers present installment plans without high interest to the buyer; the cost appears as a fee to the seller.

When high, fees are charged, corporate card they must be transparent and compared to the total cost of the.

| Aspect | credit card | or traditional installment credit. | Checkout installment |

|---|---|---|---|

| Credit card | Traditional installment credit | Impact on credit limit | Does not consume limit |

| Consumes overall limit | Depends on the contract | Bureaucracy | Low, quick decision |

| Medium, prior enrollment | High, documentation required | Costs to the buyer | Often interest-free |

| High revolving interest | Variable interest and charges | Operational risk | Transferred to partner or self-managed |

Risk borne by the issuer

Risk borne by the store When it makes more sense to use each option, Point-of-sale installment is recommended for higher- credit limit. do corporate card.

The corporate card value.

purchases, when the client needs to preserve cash or free up their.

credit limit. The, high credit card.

remains efficient for small, recurring expenses already integrated into the company's routine.

Traditional installment credit can be advantageous if the seller has a mature credit structure and can secure better rates in the long term.

Recommendation:

simulate the total cost—fees, interest,. and default risk—by customer profile and ticket size before choosing the alternative. Benefits of BNPL for selling companies and corporate clients.

Adding a direct installment option at checkout addresses cash flow limitations and increases buyer confidence. This creates a practical option that reduces abandonment at the moment of finalization.

Less abandonment and higher conversion.

Less cart abandonment:

by offering an alternative that preserves the client's cash, the conversion rate increases.

More choices

reduce friction and accelerate decision-making.

- Higher average ticket and higher-value sales.

- Installment plans enable larger purchases—such as inventory restocking or equipment—increasing the seller's ticket size and revenue.

Sell on credit, receive cash upfront

When the seller receives the full amount the next day, cash flow improves. This increases predictability, reduces the need for working capital, and facilitates financial planning. analysis Monetization and operation.

Delinquency and credit policy

A sound policy defines criteria by segment, limits per CNPJ, and payment behavior indicators. Periodic reviews based on portfolio performance help adjust limits and offers.

Collection and operational costs

Collection requires processes, channels, and technology. When volume grows, scale reduces unit cost; without it, operational cost can exceed commercial gain.

Regulation and compliance

Depending on the product, format, it may be necessary to formalize contracts such as CDC or CCB and work with authorized partners. This avoids legal and reputational risks.

Security, antifraud, and data

Identity validations, data checks, and transactional monitoring reduce exposure to fraud. Analytical models balance approval and losses, enabling customer segmentation and pricing adjustments.

Practical measures: start with conservative limits, test A/B policies, apply proactive collection rules, report to credit bureaus when appropriate, and maintain governance with clear KPIs.

How to choose a B2B BNPL solution: vendor evaluation criteria

Choosing the right partner requires assessing integration, risk, and operational support. First, confirm implementation time, API quality, and White Label option to maintain the existing checkout flow.

Credit engine: prioritize decision speed and modeling that uses multiple signals. Analytical capability defines the balance between approval and losses.

Collection management: verify receivables automation, proactive communication rules, and aging reports. This reduces delays and internal cost.

Analyze the partnership model : who assumes the risk, transfer timelines, and reconciliation processes. Comprehensive platforms (technology, regulatory, and financial) tend to accelerate go‑live.

Flexibility and KPIs

Look for offerings with digital installment plans, CDC/CCB, purchase financing, and installment Pix. Variety of product expands market reach.

- Essential KPIs: checkout conversion, approval rate, average ticket, delinquency, and incremental revenue.

- Adapt parameters to the audience: SMEs, mid‑sized, or large companies have distinct profiles and seasonality.

Modules and operational journey of an end‑to‑end BNPL platform

A complete platform orchestrates from borrower registration to portfolio management, with real‑time decisions.

Corporate borrower onboarding

The process collects registration data and risk signals with minimal friction. Essential fields and external validations accelerate conversion.

Automated analysis and decision

The combination of rules and scoring enables analysis in seconds. The platform defines the number of installments, eligibility, and possible down payment.

Formalization and receipt flow

Electronic contracts and evidence are recorded for audit. The seller can receive upfront (e.g., D+1), improving financial planning.

Receiving and collecting: automation and CRM

Proactive rules automate reminders and negotiations. A CRM with aging view reduces cost and increases recovery.

- Scalability: Dynamic limits for good payers.

- Flexibility: Segmented campaigns via API/White Label.

- Governance: Logs and reconciliation that reduce rework between systems.

Conclusion

Embedded credit offers in the payment flow reduce friction and make higher‑value purchases more feasible for companies and legal buyers.

In practice, the customer pays in installments while the seller can receive upfront through a partner. This preserves the Credit card limit and provides predictability to cash flow.

More than installment splitting, it is a credit operation: risk policies, data, analysis, antifraud, and collection define success or loss.

Before contracting, map objectives (conversion, ticket, receipt), customer profile, and margins. Request a demo, run a pilot, and monitor approval and delinquency.

For those seeking to accelerate sales and simplify payment, an end‑to‑end platform (API/White Label) reduces implementation time and operational complexity. Consider a controlled test and clear goals before scaling to the entire business. pay later