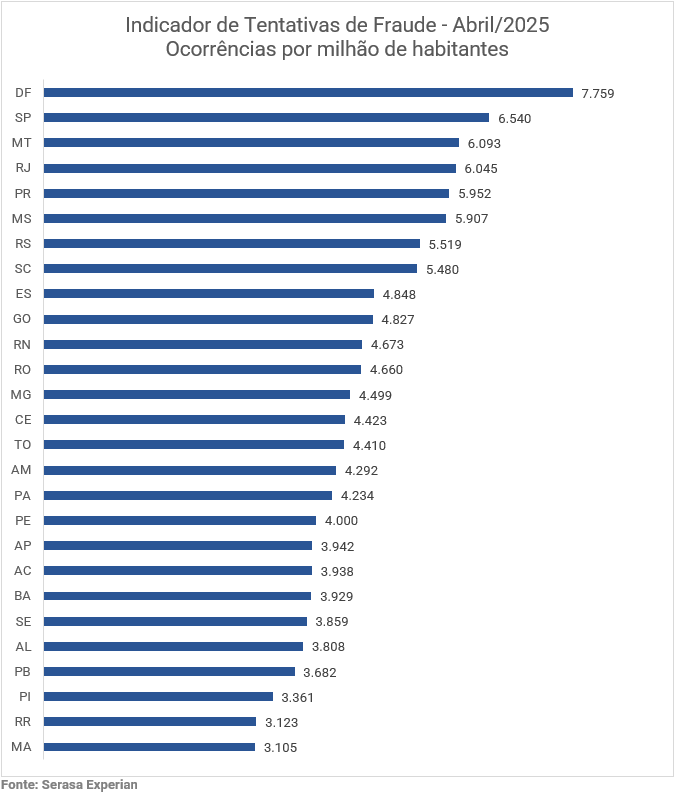

Frauds in Brazil are advancing on a new target: the youth. According to Serasa Experian’s Fraud Attempt Indicator, the first and largest datatech company in Brazil, the number of scams targeting individuals up to 25 years old increased by 50.2% in April 2025 compared to the same period last year. The shift in focus by criminals reveals a dynamic in attack strategies that target highly connected profiles with less financial history. The survey also reveals that the country recorded 1,101,410 fraud attempts in the month, equivalent to one every 2.4 seconds — a volume that has remained above 1 million since January.

“In general, fraud attempts continue to evolve rapidly, driven by technologies like artificial intelligence and the sophistication of social engineering tactics. It’s no longer just about volume, but the quality of the scams,” highlights Serasa Experian’s Director of Authentication and Fraud Prevention, Caio Rocha. “In this scenario, the adoption of layered anti-fraud strategies is essential. Integrated solutions that operate at different stages of the digital journey allow for precise identification of suspicious behaviors and proactive action, reducing risks before fraud materializes. Additionally, it’s essential to continuously raise awareness among consumers, who continue to be targets of scammers,” he concludes.

Check the graph below for the monthly evolution of fraud attempts over the last 12 months:

Economically active adults remained the main focus of scammers. In April, the age group of 36 to 50 years old was the most targeted by fraud attempts, accounting for a third (33%) of the occurrences detected. Following are the age groups of 26 to 35 years old (26.3%) and those up to 25 years old (15%).

However, in comparison with April 2024, the highest proportional growth was recorded among the younger ones: the participation of victims up to 25 years old increased by 50.2%, revealing a worrying trend of expanding the reach of frauds among individuals with less credit history or previous exposure. The age groups of 26 to 35 years and 36 to 50 years also showed significant increases of 38.2% and 26.8%, respectively.

“The significant growth of fraud among the younger generation raises an important alert. This group, often with little credit history and less familiarity with digital traps, has become a new strategic target for scammers. It is essential that fraud protection begins early, with access to information and digital education, as well as constant monitoring tools and review of processes at each stage of the journey by companies, in order to ensure layered protection throughout the process, from customer registration to purchase,” says Caio Rocha, Authentication and Fraud Prevention Director at Serasa Experian.

Among the older audiences, the participation of 51 to 60 years increased by 21.1%, while the group above 60 years saw an increase of 11.7% in the period, reinforcing that, although with lower total volume, fraudsters continue to target more vulnerable profiles in terms of digital experience or access to information.

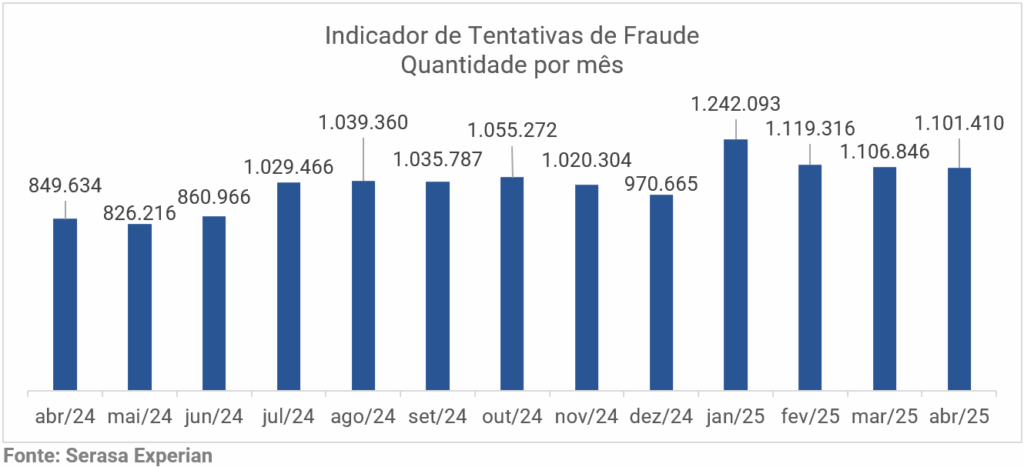

Banks remain the main target of fraudsters, but Telecommunications led in annual growth

The Banks and Cards sector continued to lead the ranking of fraud attempts in Brazil, concentrating 54.2% of the records in April 2025. Following are the sectors of Services (30.9%), Financial Institutions (7.2%), Telecommunications (5.8%), and Retail (1.9%).

All segments recorded an increase compared to April 2024, with emphasis on the Telephony sector, which showed the highest jump: a 61.1% growth in fraud attempts. Following that, Banks and Cards grew by 32.9%, while Services saw a rise of 23.9%. Financial Institutions and Retail showed increases of 19% and 9.5%, respectively.

Frauds with manipulated data at the time of registration represent more than half of the attempted frauds avoided

In the analysis by modality, most of the fraudulent attempts were identified due to registration inconsistencies (52.1%) identified in April 2025. This modality includes discrepancies in personal data provided at the time of registration, such as CPF, name, address, or phone number, which do not match reliable sources or show signs of manipulation.

Alerts related to document authenticity and biometric verification, responsible for 39.9% of the attempted frauds avoided, appeared in second place. Finally, suspicious behaviors on devices, such as accesses from equipment linked to previous fraud attempts or anomalous navigation patterns, accounted for 8% of the frauds blocked in the period.

The Southeast region concentrates almost half of the frauds, but the North leads proportional growth

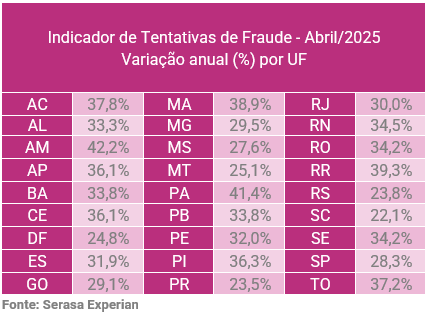

The Southeast region continued to be the epicenter of fraud attempts in the country, with 521,451 occurrences in April 2025, representing 47.3% of the national total. The ranking followed with Northeast (246,550), South (177,351), North (79,431), and Midwest (76,627). Nonetheless, when observing the annual variation by region, the North led the proportional advance, with a 38.3% increase in fraud attempts compared to the same month of the previous year. The Northeast also showed strong growth (+33.7%), with highlights in states like Amazonas (+42.2%), Pará (+41.4%), and Maranhão (+38.9%).

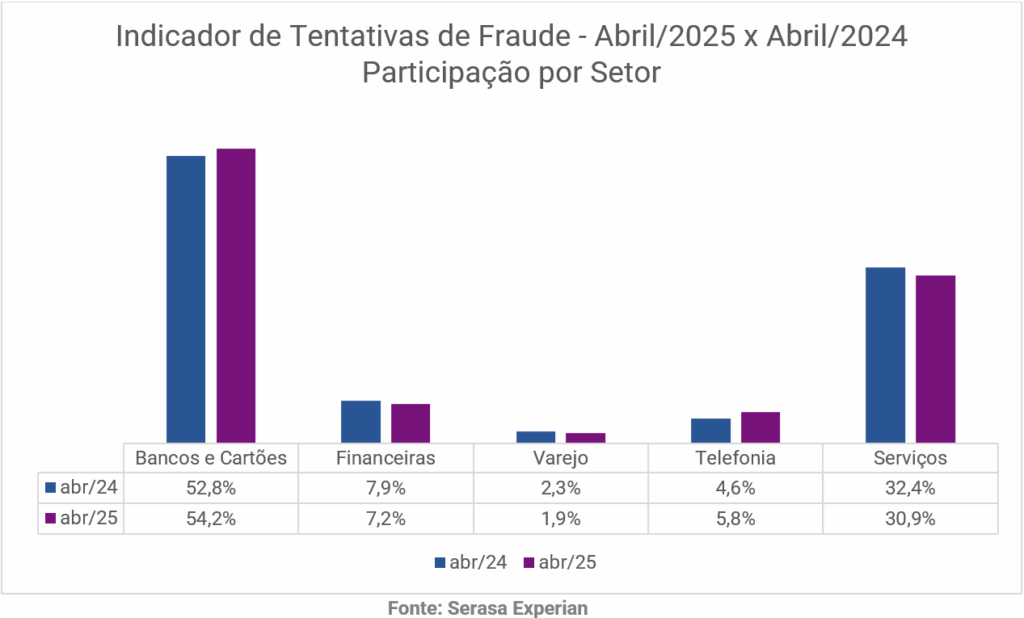

The federative unit (UF) of São Paulo led alone in the monthly quantity of records, with 301,195 occurrences, followed by Rio de Janeiro (104,117) and Minas Gerais (96,161). On the other end, Roraima (2,290) and Amapá (3,176) showed the lowest absolute volumes, although both registered significant increases compared to April 2024, by 39.3% and 36.1%, respectively.

Despite already concentrating high volumes, the Southeast (+29.9%) and Midwest (+27.3%) also recorded significant growth. The South region, although having the lowest variation rates, still showed an increase of 23.1%, with Paraná standing out by adding over 70 thousand occurrences in the month.

Below is a chart showing the quantity of fraud attempts by UFs, followed by a table with the annual variation:

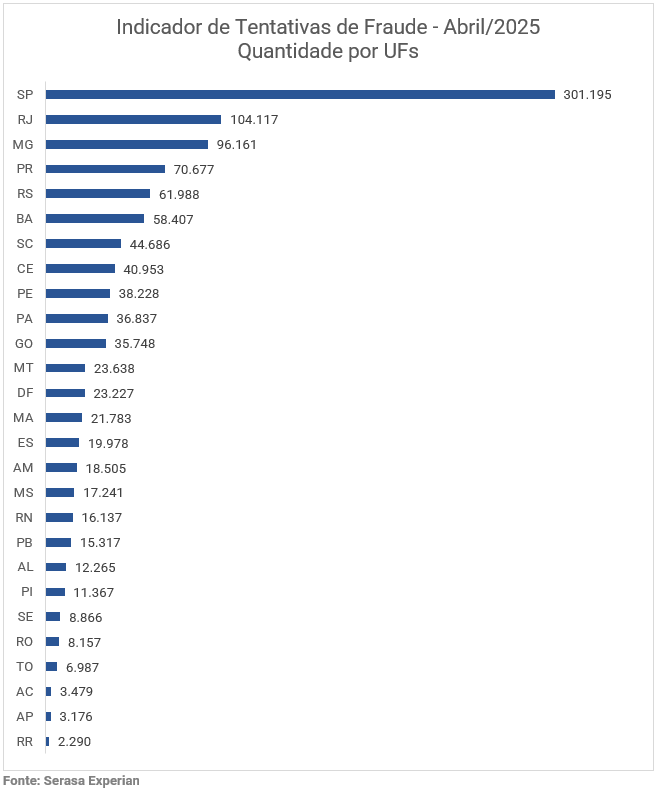

In proportional analysis to the population, the Federal District had the highest fraud attempt rate in April 2025, with 7,759 occurrences per million inhabitants. Following are the states of São Paulo (6,540), Mato Grosso (6,093), and Rio de Janeiro (6,045) all above the national average of 5,166, with a strong digital presence and high banking penetration, factors that increase exposure to risk.

On the other end, Maranhão (3,105), Roraima (3,123), and Piauí (3,361) recorded the lowest densities, although some of these states showed significant increases in the annual comparison, indicating a possible movement of frauds to the interior regions. Check out the graph with complete density information by states: